The End of

Uncertainty.

"Breastfeeding is the only vital sign managed by intuition alone."

The Milk Graph™

The world's first longitudinal dataset connecting maternal physiology to infant development.

Consumer Wedge

5K-10K paying mothers prove product-market fit, then scale to $15.4B clinical enterprise.

$2.5M Pre-Seed

Ship BMMPP, prove traction, lock clinical pilots. 15-80x projected ROI.

Momentum

Five Questions Answered

What investors ask most often—answered clearly, without hand-waving.

Why now & what problem are you solving?

The Problem: 40% of mothers quit breastfeeding within 3 months due to "insufficient supply" anxiety—they have no objective data about milk intake.

Our Approach: Launch as consumer wellness product first (BMMPP). Fast market entry, no FDA delays. Prove product-market fit with paying mothers, then scale to hospitals and regulatory approval.

Why Now: Parents demand quantified solutions. Technology is ready (sensor commoditization, AI maturity). Consumer-first path de-risks the business before expensive hospital/FDA investment.

How big is the market?

Total Addressable Market: $15.42B across consumer, hospital, government, and international segments.

Realistic Capture: $150M-$200M ARR by Year 5 (2.3-3.0% penetration).

Path to Valuation: Clear path to $1.0B-$1.2B valuation (Series B+), with $8B-$15B exit potential at scale.

What is your competitive advantage?

The Only Integrated Ecosystem: MonBe serves consumers, professionals, hospitals, and payers simultaneously. Competitors pick one and stay small.

Network Effects Moat: Consumer data → Professional insights → Hospital adoption creates a virtuous cycle competitors can't replicate.

Technical Edge: 6-sensor fusion (Ultrasound, Bioimpedance, Acoustic, Vibration, Pressure, Temperature) vs. competitors' single sensor. 30-40% higher accuracy. NFC transfer, provisional patent filed Aug 2025.

Who is the team & how do you scale?

Founder: Eitan Halfon, Ex-SolarEdge (NASDAQ: SEDG). BSc EE, MSc Economics. Hardware systems at scale.

Go-to-Market:

- Phase 1: Consumer Launch (5K-10K mothers, prove fit)

- Phase 2: FDA 510(k) + Hospital Sales (RPM billing)

- Phase 3: Nordic/Germany Expansion

- Exit: Strategic acquisition or IPO ($1.0B-$1.2B+)

How do you make money?

Dual Revenue Streams: Consumer (B2C) + Professional (B2B)

Consumer: $249 core + $45-65/mo patches + $5-15/mo app premium = $450-700 LTV

Professional: $25K-250K/year hospital software fees (workflow integration, RPM billing, dashboard)

Year 5: $150M-$200M ARR | LTV:CAC >8:1 | 70%+ Gross Margins

The Global Gap

WHO and UNICEF have set aggressive 2030 targets for exclusive breastfeeding. Today, the primary driver for failure isn't lack of will—it's anxiety driven by the absence of data.

The Question

"Is my baby eating enough?" — has no reliable answer outside a clinic.

The 6-Sensor Standard

Hardware is the entry ticket. Intelligence is the moat. MonBe uses AI-powered 6-sensor fusion to capture the full physiological spectrum of a feeding session.

Passive Wearable

Soft adhesive breast patch with reusable electronic core. Zero continuous Bluetooth near baby (NFC-sync). Multi-week charge.

6-Sensor Fusion

Ultrasound, Bioimpedance, Acoustic, Vibration, Pressure, Temperature. 30-40% higher accuracy than single-sensor competitors.

ML Insights

Real-time analysis of flow rate, letdown timing, sucking vigor, and emptying efficiency. Data that builds clinical trust.

Best Minimal Mother Pay Product

Pre-seed strategy: ship the smallest product that mothers pay for and that generates repeatable data. We win by proving demand, retention, and signal quality—fast.

The Data Moat.

The Milk Graph™

MonBe isn't a gadget; it's an Intelligence Platform. By solving the user interface, we unlock the first objective dataset in lactation history.

6-Sensor Multi-Modal Fusion

Ultrasound

MHz piezo for internal duct activity

Bioimpedance

4-electrode tissue and fullness change

Acoustic

Dual MEMS for suck, swallow, breathe

Vibration

Jaw motion and sucking rhythm

Pressure

Suction strength, seal, pattern

Temperature

Precise skin or milk thermal trend

Tap-to-phone NFC sync

Full day data in <5s, no always-on radio

AI engine

Turns signals into intake estimate, latch score, patterns

Timing, intensity, rhythm, feeding phases across every session

Nutritive vs comfort patterns, swallowing signatures, active vs passive time

Preventing $9,500 jaundice readmissions through early-warning intake metrics

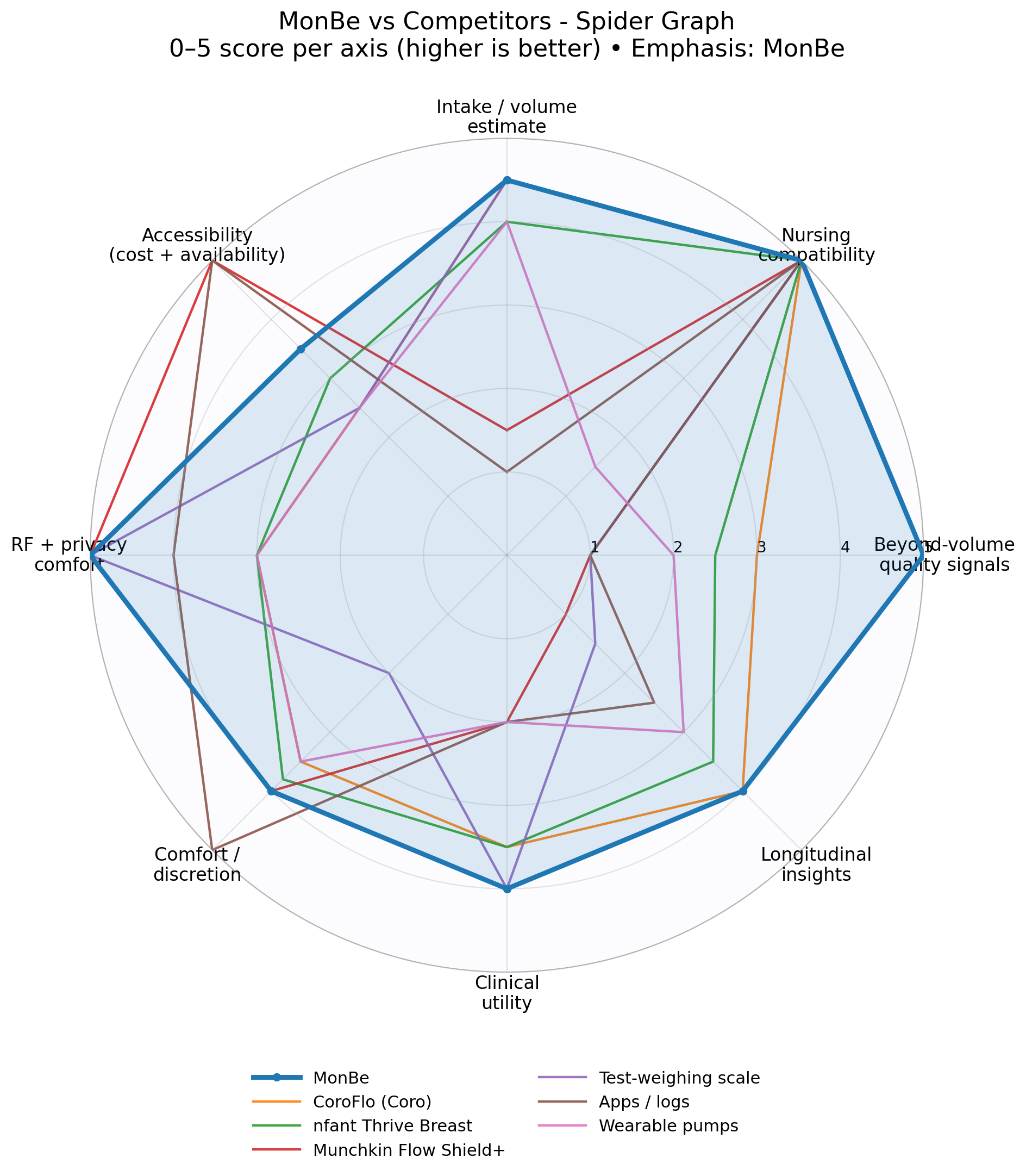

MonBe vs. The Competition

6-sensor fusion outperforms single-sensor competitors across all key dimensions.

* Multi-sensor approach provides 30-40% higher accuracy than single-sensor competitors

A $15.4B TAM

Defensible revenue across validated market segments.

Revenue Pathways

Consumer (Immediate)

Direct-to-consumer revenue from day one. Core device + recurring patches + optional premium app.

Clinical Programs

Pilot programs with lactation teams and hospitals to prove outcomes and build clinical dataset.

Enterprise (Scale)

Hospital software fees + RPM billing. Hundreds of dollars per dyad depending on workflow and payer mix.

Pre-Seed Milestones

Success Criteria

BMMPP shipped, stable UX, repeatable signal capture

5K-10K paying mothers, retention signal, improving models

3-5 pilot sites, validation endpoints, LOIs for Series A

Dataset growth, improved models, IP expansion

Financial Trajectory

Execution Roadmap

5K-10K paying mothers, MVP launch, initial clinical data collection

FDA 510(k) clearance, 3-5 hospital pilots, Series A fundraising

50-100 hospitals, CE Mark, Nordic expansion, $150M-$200M ARR

10% market penetration, $1.5B revenue, strategic exit or IPO

The $2.5M Ask

"Join us in building the objective foundation for infant health."

Use of Funds

Structure & Returns

SAFE or Convertible Note for rapid go-to-market velocity.

Eitan Halfon

"I am building what I wish we had for our twins. Engineering rigor, financial discipline, and lived pain."