Ending the

$341B Global Crisis

Breastfeeding is the only vital sign managed by intuition alone. We're fixing that with The Milk Graph™.

Breastfeeding is the only vital sign managed by intuition alone. We're fixing that with The Milk Graph™.

WHO/UNICEF set ambitious breastfeeding targets. Current reality falls catastrophically short—creating a $341B global crisis.

Exclusive Breastfeeding (0–6 months)

Early Initiation (within 1 hour)

Continued at 1 year

8.77M births in Western markets annually

Initiate breastfeeding in Western countries

Quit within 3 months due to supply anxiety without data

Preventable Child Deaths Annually

1,500 deaths every day

Annual Global Economic Loss

$285B in cognitive losses

Lost per Medium Hospital/Year

Preventable readmissions

The world's first proprietary dataset on real-time infant intake and latch efficiency. Our primary clinical moat.

Data Monetization Potential: $85M–$640M/year

Volume (ml), Flow Rate (ml/min), letdown timing, breast emptying efficiency

Sucking vigor, rhythm, active vs. passive feeding time

Impact of diet, sleep, and stress on supply

Prevent $9,500 readmissions via predictive analytics

Understand "mixed feeding" triggers for 60% of mothers

Objective endpoints for galactagogue drug trials

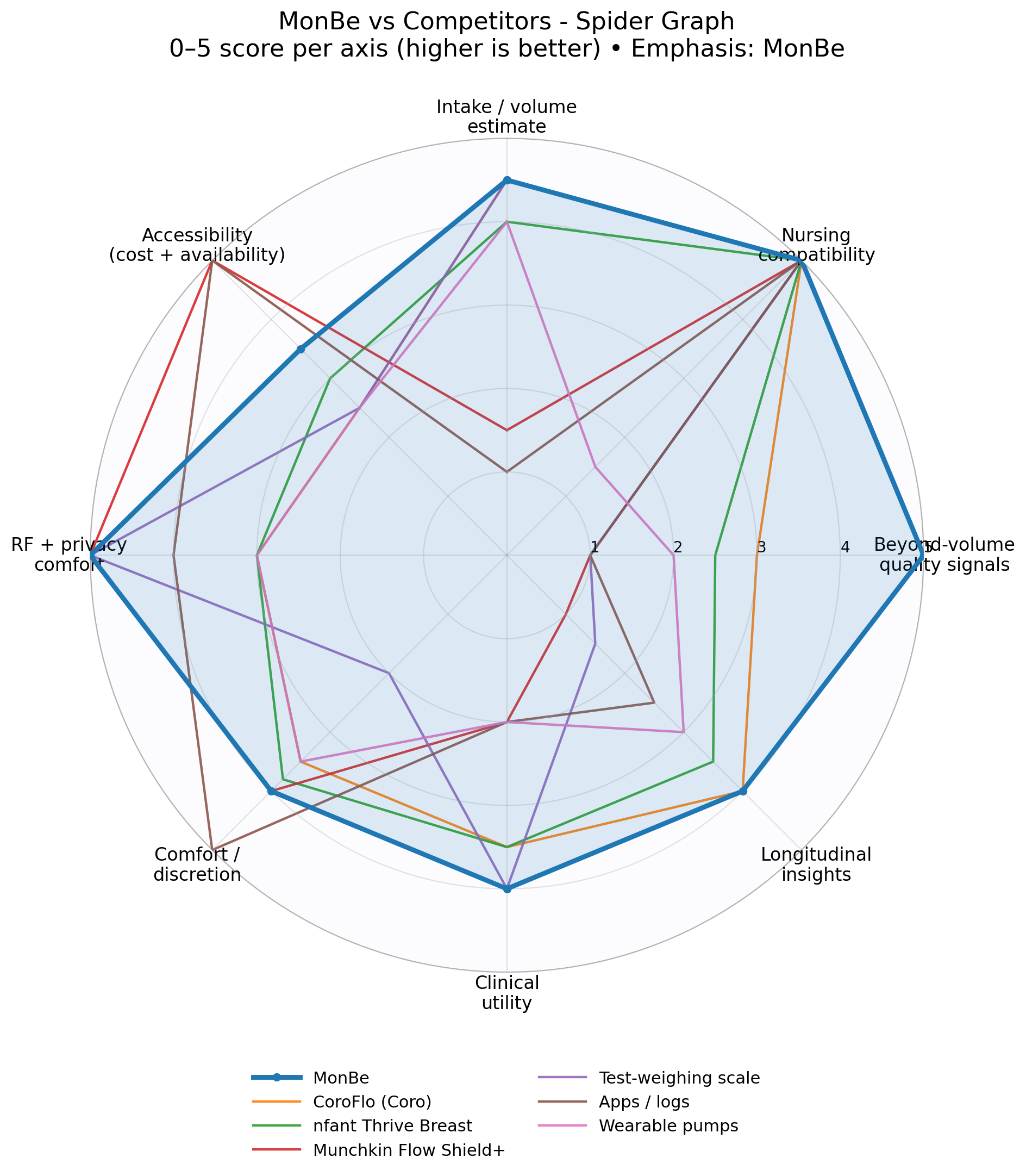

Multi-sensor, AI-powered lactation monitoring system with 30-40% higher accuracy than single-sensor competitors

Ultrasound, Pressure, NIR, Bioimpedance, Accelerometers, Microphones work together for unprecedented accuracy

Reusable core + disposable breast patch. NFC-based, no Bluetooth near baby

6 sensors capture volume, flow, latch quality. Real physiological data

NFC transfer to phone. 3-week battery life, zero radiation during feeding

Tracks swallow volume dynamics in real-time. This provides the ground-truth intake data for The Milk Graph™.

Multiple revenue streams across consumer, hospital, government, and international markets

| Revenue Stream | Value | % of TAM |

|---|---|---|

| Consumer (B2C) | $4.75B | 31.7% |

| Hospitals (B2B) | $4.50B | 30.0% |

| International Expansion | $1.91B | 12.7% |

| Government/WIC | $1.66B | 11.1% |

| Pharmacy/Retail | $800M | 5.3% |

| Professional/IBCLC | $500M | 3.3% |

| Pediatrics & Data Analytics | $300M | 2.0% |

| TOTAL TAM | $15.42B | 100% |

CPT codes provide $565.15 reimbursement over 6 months

Section 2713 requires 100% coverage with zero cost-sharing

ROI-based pricing capturing $2.8M potential savings

SAFE or Convertible Note | Projected 15-80x Investor ROI

Complete hardware + software development

510(k) & CE Mark submission

Clinical validation & hospital pilots

Key executive hires

5K-10K paying mothers, MVP, initial clinical data

510(k) clearance, 3-5 hospital pilots, Series A

50-100 hospitals, Nordic expansion, $150M-$200M ARR

$1.5B revenue, strategic acquisition or IPO

Electrical Engineer (BSc) | Ex-SolarEdge (NASDAQ: SEDG) | MSc Global Financial Economics | Former Military Officer

Website: monbecare.com

Investment Inquiries: investors@monbe.com